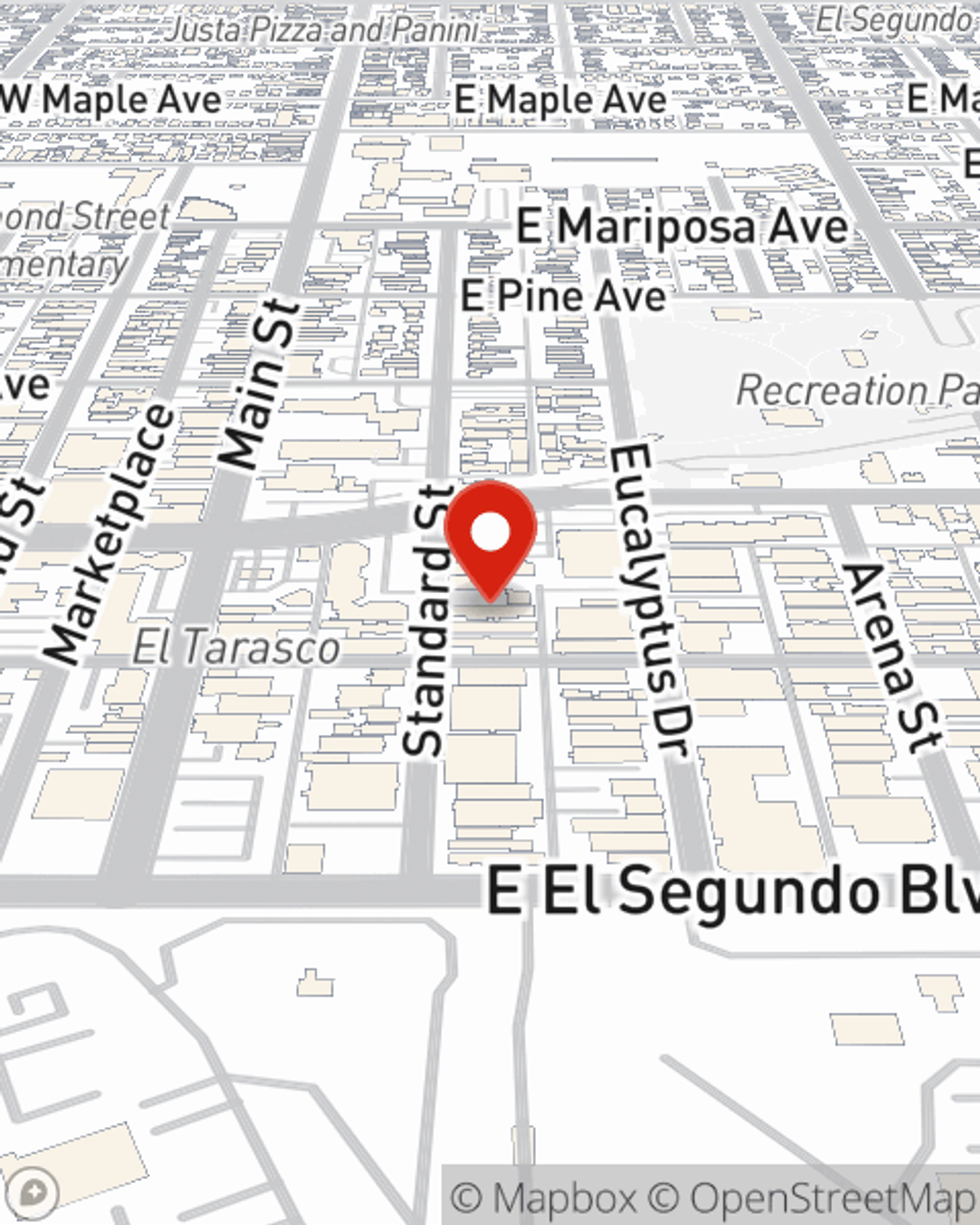

Business Insurance in and around El Segundo

One of the top small business insurance companies in El Segundo, and beyond.

Helping insure small businesses since 1935

- El Segundo

- Manhattan Beach

- Hawthorne

- Redondo Beach

- Inglewood

- Westchester

- Hermosa Beach

- Downey

- Arizona

- Oregon

Help Prepare Your Business For The Unexpected.

Do you own a HVAC company, a home cleaning service or a travel agency? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on what matters most.

One of the top small business insurance companies in El Segundo, and beyond.

Helping insure small businesses since 1935

Keep Your Business Secure

Your business is unique and faces specific challenges. Whether you are growing a cosmetic store or a craft store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your layout, you may need more than just business property insurance. State Farm Agent Brandon Foster can help with worker's compensation for your employees as well as professional liability insurance.

As a small business owner as well, agent Brandon Foster understands that there is a lot on your plate. Get in touch with Brandon Foster today to review your options.

Simple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Brandon Foster

State Farm® Insurance AgentSimple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.